Renters insurance is often seen as an unnecessary expense, especially by those who believe their possessions are not valuable enough to warrant such coverage. However, this belief can be misleading. In reality, renters insurance offers a layer of protection and peace of mind that can be invaluable in the event of unexpected incidents. If you’re currently renting a home or an apartment, understanding the ins and outs of renters insurance is crucial.

When disasters strike—whether it's a fire, theft, or water damage—having renters insurance ensures that you're not left to shoulder the financial burden alone. It protects your personal belongings and provides liability coverage should someone be injured while on your premises. With so many policies available, knowing what to look for can help you secure the best coverage at a reasonable rate.

In this article, we will break down everything you need to know about renters insurance: what it is, why you need it, what it covers, how much it costs, and how to choose the right policy to meet your needs.

What Is Renters Insurance?

Renters insurance is a type of insurance policy designed to protect individuals living in rented properties. It covers personal belongings against various risks such as theft, fire, and certain types of water damage. Because tenants do not own the physical structure they live in, renters insurance does not cover the building itself, which is typically the landlord's responsibility. Instead, it focuses on safeguarding the tenant's personal property.

Most renters policies also include liability coverage, which protects against legal claims resulting from injuries that occur on the rental premises. For example, if a guest slips and falls and decides to sue, your renters insurance can help cover legal fees and damages awarded by the court.

Additionally, renters insurance can provide coverage for additional living expenses in case your unit becomes uninhabitable due to a covered event. This can include hotel bills or other necessary costs you might incur while finding alternative living arrangements.

Why Do You Need Renters Insurance?

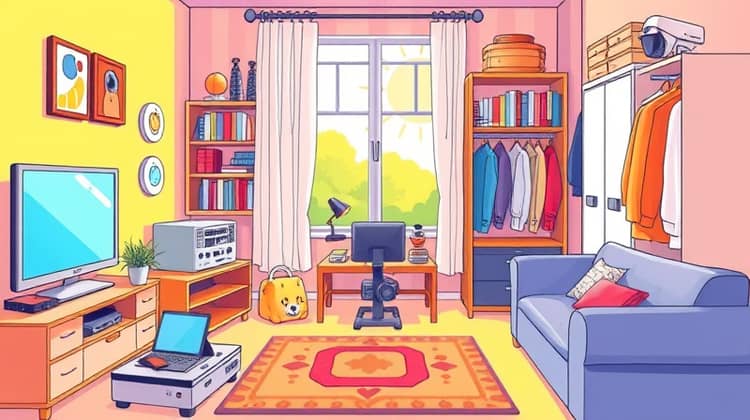

One of the primary reasons to get renters insurance is for personal property protection. Many people underestimate the value of their possessions, but even a small apartment can contain thousands of dollars' worth of furniture, electronics, clothing, and other valuables. In the event of a theft or disaster, replacing these items without insurance can lead to significant financial strain.

Moreover, renters insurance provides liability coverage, which is essential for protecting yourself financially. If someone gets injured in your home and decides to take legal action, the costs can be exorbitant. Liability coverage can help cover legal fees and medical expenses, preventing you from facing potential bankruptcy due to a lawsuit.

Another compelling reason for obtaining renters insurance is peace of mind. Knowing that your belongings are protected and that you have coverage in the event of an accident can relieve a lot of stress that comes with renting a home. It's about creating a safety net that allows you to enjoy your living space without constantly worrying about the 'what ifs.'

Finally, if you're renting, you might be required by your landlord to carry renters insurance as part of the lease agreement. This policy ensures that both you and your landlord are protected in case of damages or incidents that affect the rental property.

How Much Does Renters Insurance Cost?

The cost of renters insurance can vary significantly depending on several factors, including the amount of coverage you need, your location, and the insurance company you choose. On average, renters insurance policies can range from $15 to $30 a month, making it one of the more affordable types of insurance you can purchase. However, it's important to shop around and compare quotes from different providers.

Your premiums may be higher if you live in an area prone to natural disasters or high crime rates. Additionally, if you have valuable possessions that require more coverage, you may need to opt for a higher limit, which can increase your monthly costs. Factors like credit score and previous claims history can also affect your insurance rates; a good credit score generally leads to lower premiums.

Another consideration is your chosen deductible, which is the amount you agree to pay out of pocket before your insurance kicks in. A higher deductible can lower your monthly premiums, but it's crucial to weigh the pros and cons. If you ever need to file a claim, being able to cover a higher deductible is important, so make sure it's an amount you can afford.

Most insurance companies offer discounts for bundling policies, maintaining a claims-free history, or installing security features in your rental unit. Further, some employers or organizations might provide discount offers, so inquire about this if you're shopping for renters insurance.

What Does Renters Insurance Cover?

Renters insurance generally provides coverage for personal property, liability protection, and additional living expenses. Personal property coverage protects your belongings such as electronics, clothing, furniture, and personal items against risks such as theft, fire, and vandalism. It's vital to keep an inventory of your possessions for easy claims in the future.

Liability protection is also a crucial component of renters insurance. If someone is injured in your rented home and decides to take legal action, liability coverage can help cover the legal fees and any damages awarded. In case of emergencies where you need to find alternative accommodations, renters insurance can assist with the extra expenses incurred during that time.

- Personal Property Coverage: Protects your belongings against theft, fire, vandalism, and more.

- Liability Coverage: Protects you against legal claims for injuries or damages that occur in your rental unit.

- Additional Living Expenses: Covers costs of living elsewhere if your rental becomes uninhabitable due to a covered event.

What Renters Insurance Doesn’t Cover

While renters insurance offers extensive coverage, it's important to know its limitations. For example, most policies do not cover damage to the physical building or its underlying structure since that is the landlord's responsibility. Renters insurance also typically doesn’t cover maintenance issues or damage due to neglect or inadequate upkeep.

Certain perils, like floods and earthquakes, are usually not included in standard renters insurance. If you live in an area prone to such events, consider purchasing additional coverage to protect your belongings against these specific risks.

- Damage caused by natural disasters like earthquakes or floods (unless additional coverage is purchased).

- Loss or damage related to business-related activities conducted from the rental unit.

How to Choose the Best Renters Insurance

Selecting the best renters insurance policy for your needs can feel overwhelming, but breaking it down into manageable steps can help. Start by assessing the value of your belongings; this will allow you to decide on the appropriate amount of coverage. Make a comprehensive inventory of your assets to have a clearer picture of what needs protection and how much coverage you should seek.

Next, shop around and obtain quotes from multiple insurers to compare policy features, pricing, and customer reviews. Look for providers that offer good customer service and claims support, as well as any available discounts. Reading reviews and getting recommendations from friends and family can also guide you towards reputable insurance companies.

- Assess the value of your belongings for adequate coverage.

- Shop around for quotes from different insurance providers.

- Look for discounts on premiums if eligible.

- Read customer reviews and check insurers’ customer service ratings.

Once you've gathered your options, review the policy details to ensure you understand what is included and excluded before making a final decision. Ultimately, the best renters insurance is one that meets your specific needs while fitting within your budget.

Conclusion

In summary, renters insurance is a wise investment for anyone renting a home or apartment. It protects your personal belongings, provides vital liability coverage, and offers peace of mind amid potential risks. Whether you're a first-time renter or have been renting for years, evaluating your need for insurance should be a priority.

With the average cost of renters insurance being relatively low, the benefits it offers far outweigh the expenses. Additionally, the potential financial relief in case of theft or damage can be life-changing, preventing you from facing unforeseen economic hardships. Not to mention, the security provided by having a safety net in place can minimize the stress that comes with renting.

By understanding the ins and outs of renters insurance, you can make an informed decision about the right policy to suit your needs. Remember to consider the extent of coverage, the costs, and any optional add-ons that may be necessary for your situation.